2024 Toyota Camry Launched In India At Rs 48 Lakh; Now...

- Dec 11, 2024

- Views : 15684

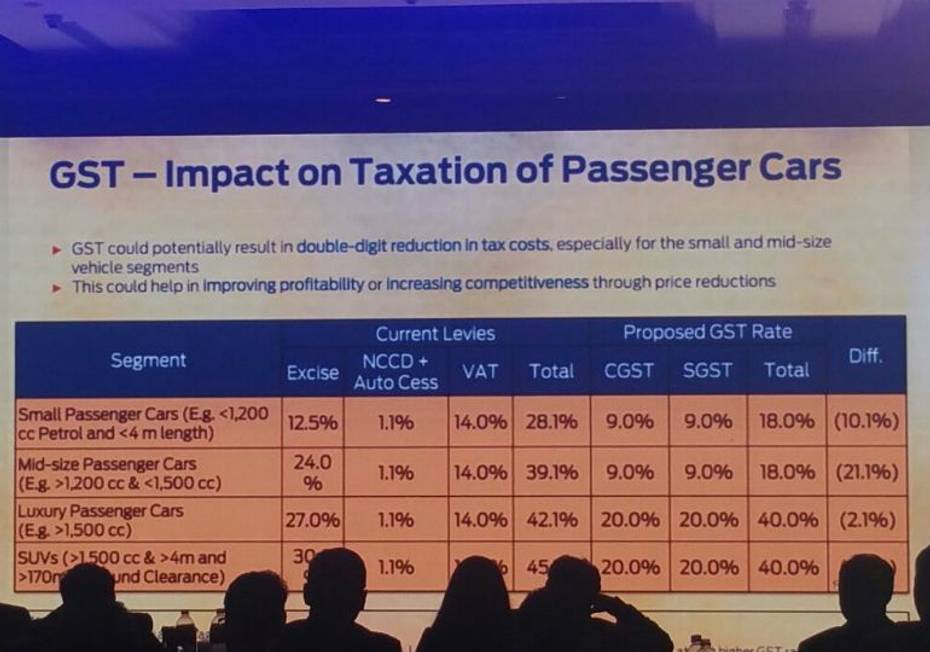

The GST or the Goods and Services Tax bill is the biggest talk of this year’s budget. Some say that it could upset the balance of the economy, some are saying it is flawed in its current state whereas others are saying that if it isn’t passed it could lead to crisis in the Indian economy. And even the auto industry has its differences when it comes to the GST bill. But before we delve into that we need to know what the GST bill is. Well, in the simplest of terms, it is a tax that is a culmination of all the taxes we pay already like VAT and excise duties into one singular tax, the GST.

Now, it holds different pros and cons to different people and for the car customers it’s mostly good news but the manufacturers themselves seem to be divided on the contents of the bill.

For cars, the GST consists of four categories, Small passenger cars below four meters in length and under 1,200cc, mid-size passenger cars, between 1,200-1,500cc, luxury cars, over 1,500cc and SUVs over 1,500cc and over four meters. Currently we pay 12.5 percent excise duty on small cars, 24 percent on mid-size cars, 27 percent on luxury cars and 30 percent on SUVs. Then there is the NCCD of 1.1 percent 14 percent VAT on all of the above. If the GST bill is passed, the total tax on small cars will come down by 10 percent, the tax on mid-size cars will be lower by no less than thirty percent whereas the luxury cars and SUVs will see a tax exemption of 2.1 and 5.0 percent.

Now manufacturers like Maruti-Suzuki and Hyundai are all in favour of the GST in its current format as it gives small car manufacturers massive tax reductions. Even after the lowering of price and distribution of margins at each level of the distribution process still leaves enough margin for the car makers. This is possible as both these car makers have most of their portfolio between the 800cc-1500cc range. Car makers like Toyota and Honda get their sales from larger cars which get only 2.1 percent tax reduction. This is the reason that car makers like Maruti and Hyundai are vying for the differential approach whereas car makers like Toyota and Honda are looking for a singular slab despite the fact that eighty percent of the countries follow the differential approach.

2024 Toyota Camry Launched In India At Rs 48 Lakh; Now...

Mahindra BE 6e Launched At Rs 18.9 Lakh, Gets Modern Styling, Premium...

Kia Syros Unveiled Globally As The Most Premium Sub-4m SUV In India

Skoda Kylaq: Here’s What You Get With Each Of Its 4 Variants

Mahindra’s Top 5 Big Claims About BE 6e & XEV 9e

Mahindra BE 6e vs Tata Curvv EV: Which Electric SUV Claims The Better...

Mahindra BE 6e: A 360-degree Look At Its Exterior & Interior In 13...

Mahindra BE 6e vs XEV 9e: An In-depth Comparison Of Mahindra’s...

New 2024 Honda Amaze Arrives In India At Rs 8 Lakh

India's largest automotive community

Renault-Nissan To Bring New SUVs To India In 2025 Including The Return Of An Extremely Popular Nameplate

Renault-Nissan To Bring New SUVs To India In 2025 Including The Return Of An Extremely Popular Nameplate

Sneak Peek Into India-spec Maruti e Vitara’s Interior Ahead Of Bharat Mobility Global Expo 2025

Sneak Peek Into India-spec Maruti e Vitara’s Interior Ahead Of Bharat Mobility Global Expo 2025

This Vayve Eva, To Be Showcased At Bharat Mobility Global Expo, Can Be Charged Via A Solar Panel On The Roof

This Vayve Eva, To Be Showcased At Bharat Mobility Global Expo, Can Be Charged Via A Solar Panel On The Roof

Kia Syros Stands Out As The Most Premium Sub-4m SUV With These 5 Features

Kia Syros Stands Out As The Most Premium Sub-4m SUV With These 5 Features

Toyota Camry

Rs. 48.00 Lakh

Toyota Camry

Rs. 48.00 Lakh

Honda Amaze

Rs. 7.99 Lakh

Honda Amaze

Rs. 7.99 Lakh

Audi Q7

Rs. 88.66 Lakh

Audi Q7

Rs. 88.66 Lakh

Mahindra XEV 9e

Rs. 21.90 Lakh

Mahindra XEV 9e

Rs. 21.90 Lakh

Mahindra BE 6

Rs. 18.90 Lakh

Mahindra BE 6

Rs. 18.90 Lakh