Renault Extends Standard Warranty On Kwid, Triber, And Kiger To 3...

- Dec 30, 2024

- Views : 30394

The trials of the automotive industry in India never seem to end. After Transport Minister Nitin Gadkari’s statement about bringing an end to the growth of petrol and diesel cars in India, the cess on certain cars has been increased yet again.

The new GST cess rates will be effective from today. While this hike won’t affect small, hybrid and electric cars or 13-seater vehicles, mid-sized and luxury cars and SUVs will see an increase of 2, 5 and 7 per cent respectively. This now brings the total cess to 45, 48 and 50 per cent for the respective segments.

This move brings the taxation rates for cars almost at par with the pre-GST rates. Here, it is worth noting that cars already fall under the highest slab of GST; the luxury slab at 28 per cent, along with which they also attract an additional cess from the Government. On this, Arun Jaitley, our Finance Minister responded by saying that the cess has been increased only for large vehicles where the affordability of consumers is high. He further continued, "The pre-GST rate has not been restored... Even though we had a headspace of hiking cess by 10 per cent, it has been hiked by up to 7 per cent."

The Society of Indian Automobile Manufacturers (SIAM) expressed relief that 25 per cent tax wasn’t levied on all large cars, as they had originally feared after an ordinance on the same was promulgated last week.

However, SIAM did express its concern that if the cess rates keep hiking this frequently, it will create instability in the industry and damage its ability to contribute to the economy. According to the organisation, it forces automobile manufacturers to revisit their prices, while keeping them lucrative for customers as well.

The difference in GST of cars after the latest hike

|

TYPE |

BASE GST |

CESS + RAISE |

NET TAX |

|

Small car (Petrol) |

28% |

1% |

29% |

|

Small car (Diesel) |

28% |

3% |

31% |

|

Mid-size cars |

28% |

15% +2% |

45% |

|

Luxury cars |

28% |

15% +5% |

48% |

|

SUVs |

28% |

15% +7% |

50% |

|

Hybrids |

28% |

15% |

43% |

|

Electric |

12% |

0% |

12% |

However, SIAM is also thankful that a different tax system has been put in place for hybrid vehicles as they had requested. SIAM now hopes that the states would not go on to unilaterally increase the road taxes as now they will soon receive increased compensation through the revised cess.

To determine what category a car falls in, refer to the table below. These are the definitions of each category as described by the Government.

Car categories

| TYPE | LENGTH | ENGINE CAPACITY | EXAMPLES |

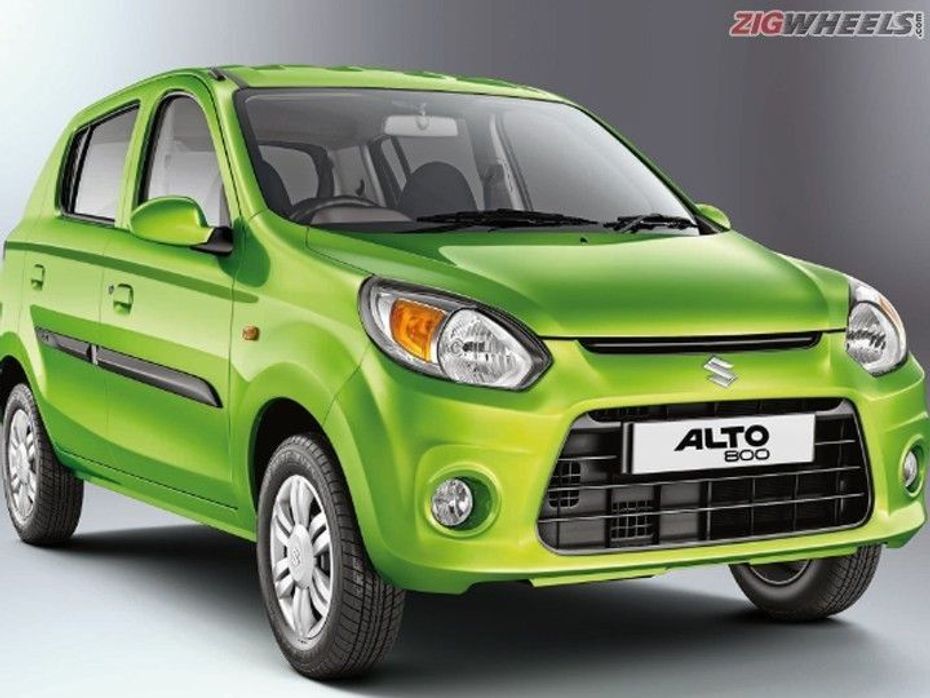

| Small Cars | Less than 4 metres | Petrol: less than 1,200cc | Baleno, Alto, Polo, Tiago |

| Small Cars | Less than 4 metres | Diesel: less than 1,500cc | Dzire, Elite i20,Vitara Brezza, Tigor |

| Mid-size Cars | More than 4 metres | Petrol/ Diesel: less than 1,500cc | Honda City, Ciaz |

| Luxury Cars | More than 4 metres | Petrol/ Diesel: 1,500cc or greater | Verna, Octavia, E-Class |

| SUVs | More than 4 metres | Petrol/ Diesel: 1,500cc or greater + 170mm ground clearance | Audi Q7,Innova Crysta Tiguan, Fortuner |

Recommended Read:

- Big Cars To Attract Additional 10% Cess

- SIAM Suggests GST Rates For Automobiles To Govt

Renault Extends Standard Warranty On Kwid, Triber, And Kiger To 3...

Is The Kia Syros More Compelling Than The Best-selling Hyundai Creta?

Auto Expo 2025 - All You Want To Know About The Hottest Auto Show!

Hyundai Creta Electric REVEALED Ahead Of Auto Expo 2025! Here’s...

Upcoming Maruti Suzuki Cars Expected In 2025: e Vitara, Baleno...

Here Is The List Of All Tata Cars Likely To Be Launched In 2025

Mahindra BE 6 Launched: Price For The Top-spec Variant Is Out!

Upcoming Mahindra Cars Expected in 2025: XUV 4XO, Thar Facelift, BE...

JSW MG Motor India Revealed Their New SUV, The MG Majestor At Auto...

India's largest automotive community

Here Is A List Of SUVs Coming To The Indian Market In 2025

Here Is A List Of SUVs Coming To The Indian Market In 2025

Check Out The List Of The Top 5 SUVs Showcased At The Auto Expo 2025

Check Out The List Of The Top 5 SUVs Showcased At The Auto Expo 2025

Auto Expo 2025: Toyota Hilux Black Edition Explained In 10 Images

Auto Expo 2025: Toyota Hilux Black Edition Explained In 10 Images

India’s Most Affordable Car, The Vayve Eva Is Priced From Rs 3.25 Lakh! Here Is A Look At All Of Its Variants!

India’s Most Affordable Car, The Vayve Eva Is Priced From Rs 3.25 Lakh! Here Is A Look At All Of Its Variants!

Vayve Mobility Eva

Rs. 3.25 Lakh

Vayve Mobility Eva

Rs. 3.25 Lakh

BMW X3

Rs. 75.80 Lakh

BMW X3

Rs. 75.80 Lakh

Hyundai Creta Electric

Rs. 17.99 Lakh

Hyundai Creta Electric

Rs. 17.99 Lakh

Lotus Emira

Rs. 3.22 Crore

Lotus Emira

Rs. 3.22 Crore

Lotus Emeya

Rs. 2.33 Crore

Lotus Emeya

Rs. 2.33 Crore