Renault Extends Standard Warranty On Kwid, Triber, And Kiger To 3...

- Dec 30, 2024

- Views : 30457

End-2009: the US and Europe are reeling under a financial crisis, which has dampened demand for virtually everything, including cars. China races in from behind to overtake the US as the world's largest car market. That's when it dawned on Carlos Ghosn, CEO of Nissan Motors, that he needed a focused, distinct strategy to squeeze growth out of emerging markets. That also explains why the Japanese carmaker has chosen to resurrect the Datsun brand which was phased out in 1986 specifically for emerging markets.

"He [Ghosn] asked me if I could give it a shot," recalls Vincent Cobee, head of the Datsun project for Nissan globally. Cobee, a former programme director for the V platform (on which cars like Micra and Sunny have been built) at Nissan, agreed to spearhead the project because, like Ghosn, he too witnessed the shift. "We saw China explode," says Cobee. "We realised something was happening and we weren't prepared for it."

In China, while Nissan is the most successful Japanese auto company, its portfolio of cars addresses just 60 per cent of the market there. "It was not just the number we also realised it was a business growth issue for us," adds Cobee. He hasn't looked back since. Over the past three years, he has put together a plan, a strategy and a team to help Nissan get a grip on the emerging markets. Datsun is the third global brand besides Nissan and Infiniti under the Nissan umbrella.

There are many reasons why Nissan is launching a separate brand for the emerging markets. One, growth in the BRICS (Brazil, Russia, India, China and South Africa) cluster is driven by a new class of customers. The company believes these customers in each of these countries have unique needs and requests, which must be addressed through a separate model line-up. Two, as Cobee says, "you don't try to sell in India the regulatory norms of the US".

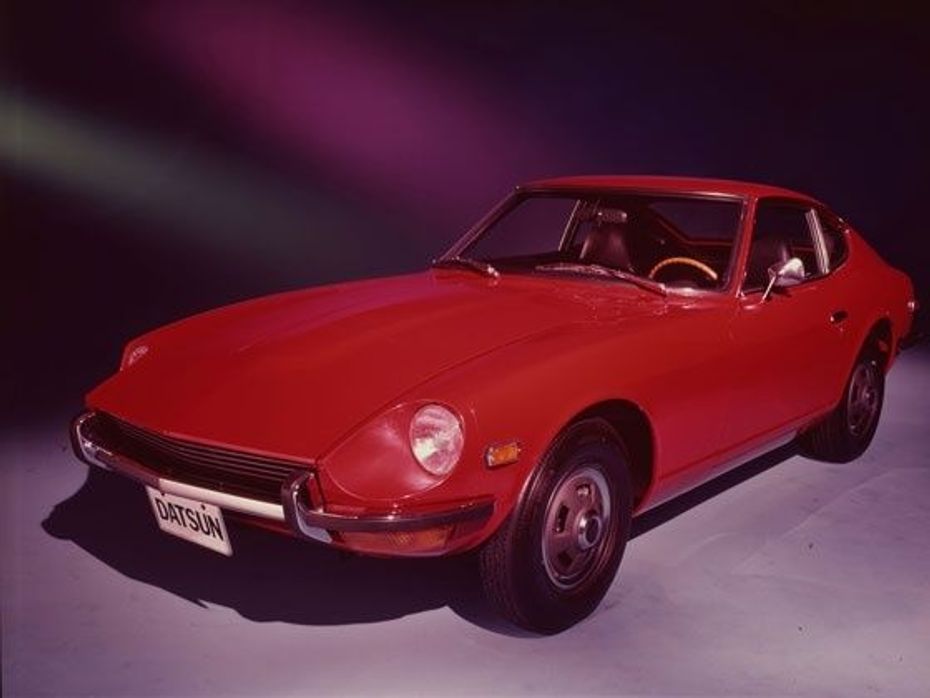

So the strategy is to decrease features without cutting down on those relevant for these markets. The first three letters of the brand Datsun stand for Dream, Access and Trust, the three pillars on which the brand is being built. Datsun cars, consistent with the label's heritage, will have modern styling, be affordable, have best-in-class fuel efficiency with emphasis on durability, safety and low cost of ownership. "Datsun was a great car for the emerging middle class then [1914-86]. That's exactly what it will be again," says Cobee.

The BRICS Dreams:

Emerging markets are difficult and require a very different strategy. "We realise that winners in each of the emerging markets are different," says Cobee. Maruti Suzuki dominates India. Toyota dominates Indonesia. Lada is doing well in Russia.

"This is because no two emerging markets are similar and hence what works for one does not work for the other," says Cobee. Emerging markets also require very different kind of cars vis-a-vis the mature markets. Motorisation typically kicks in when the per capita income is hovering around $3,000 mark. The three economies which Datsun will ride into Russia, Indonesia and India have either hit or are very close to hitting that sweet spot. Nissan also plans to launch Datsun in South Africa, which will serve as a beachhead for the African markets.

Each of these markets is structured very differently in terms of customer demand and competitive intensity and requires separate handling. For example, in India close to 70 per cent of the market is still small hatchback, Maruti's stranglehold. Nissan today has zero presence in the mass sub-Rs 4 lakh segment in India. In Indonesia and South Africa this sub-Rs 4 lakh segment does not exist.

For example, the cheapest car available in Indonesia is around Rs 7 lakh. So the demand at the bottom end -- from the emerging middle class is not there. In Russia, the Nissan-Renault alliance has a strong presence in the affordable segment (hatchbacks, compacts and sub-compacts) through the Lada brand. In all these markets, Nissan aspires to launch Datsun to stoke demand from the emerging middle class.

Nissan's New Way:

Nissan hopes to notch a market share of 10% in India by 2016-17 and a global share of 8% in the auto industry. This ambition requires the Japanese carmaker to rejig its organisational DNA and find a new way of doing business. "The next decade is about local products and global capabilities," says Cobee.

So the most important thing for the MNC will be for Japan to stop specifying what needs to be done, and to let the countries India, Indonesia and Russia in this case drive and shape what's to be done in these markets, with help from the headquarters. That's exactly how the Datsun brand and products are being developed. And that has resulted in new ways of doing things. For example, it typically takes 3-4 years for a company to move from the 'first intention' to the concept stage. The Datsun team took just six months to do it. "We have managed to crunch the timeline," says Ashwani Gupta, programme director, Datsun business unit, Nissan Motor Co.

Five models are slated to be launched: two in 2014 and three later. The first one to be launched is codenamed K2. The R&D team in India is working closely with its peers in Japan in developing the car. All Datsun cars, when launched, will be local from day one in terms of production. "The biggest challenge is how do we localise and maximise local parts," says Hidetoshi Imazu, executive V-P and member of the board, Nissan Motors. Since the beginning of the project, Nissan has been working with vendors in India to localise.

Cross-country Team:

The Datsun project, headed by Cobee, is being steered by a core team of around 15 Nissan executives drawn from different parts of the world. While each of the focus countries (Russia, Indonesia and India) has a representative on the project, there are two Indians -- based out of Yokohama -- playing a critical role. Gupta is the Datsun programme director and is leading the global charge in establishing the new brand. Krishnan Sundararajan, earlier in India at the Renault-Nissan Technical Center, recently relocated to Nissan's Technical Center in Japan.

"I have handpicked each of my team members," says Cobee, a Frenchman who joined Nissan in 2002. While the specifics of the car have not been revealed, a broad sketch of the consumer profile gives a flavour. In India, a Datsun customer would typically be a first-time car buyer, a part of the emerging middle class that looks at his future with optimism and aspirations. He would be looking for a reliable car, which offers peace of mind, has good styling, modern engineering. The car would announce an upgrade in the buyer's lifestyle. But then the Datsun range is hardly going to be a headturner. Cobee can live with that -- reliability for Datsun comes before flashy features and promises.

"You can't play heads and tails with somebody's two years' income," says Cobee. To be sure, the person buying a Datsun car will be probably making the biggest purchase in his life ever, unlike, say a higher net worth individual who wouldn't think much before forking out Rs 15-20 lakh for a swankier model. "We want it to be a celebratory step in his life. So everything the car, customer handling at the dealer, after-sales service must make him feel good about his choice of car," says Cobee. The advantage Datsun would have is that it is entering India after Nissan and it would gain from Nissan's mistakes and experience.

Vetting the Model:

That Nissan, a Japanese MNC, is doing this is hardly surprising. Headed by Ghosn, a non-Japanese, it is the most global Japanese auto company in terms of top management. Its top 100 executives come from 22 different countries and half of its 10-member executive committee is non-Japanese. Nissan, despite being a late comer in India, has moved fast to get its initial strategy right of being export-led to get quick scale, says Deepesh Rathore, MD (automotive), IHS Global Insight, a consultancy.

"It now needs a product that will rival mainstream competition like Maruti," he adds. Datsun's approach to looking at each emerging market separately is a good idea as no two emerging markets are similar, says Rakesh Batra, partner, Ernst & Young. GM's hatchback Beat, in contrast, was developed taking inputs from all emerging markets in an attempt to make it relevant for the emerging markets. "But at the end it became a compromise product with no great appeal in any of the markets," says V Ramakrishnan, MD, Frost & Sullivan India.

The biggest worry, though for Datsun is that of potential brand confusion. The Nissan label is barely established in India today. And the rebadging of Nissan Micra and Sunny by Renault as Pulse and Scala is already creating some confusion. "When Nissan itself is not an established brand here, bringing another brand may add to the confusion," says Mohit Arora, executive director, JD Power (Asia Pacific).

The other challenge is that India is already awash with affordable cars, with most manufacturers worth their market share having a significant presence in this segment. "India is in the lowest band of the price spectrum among all emerging markets. It is one of the toughest markets in the world," says Vikas Sehgal, MD Global (auto), Rothschild. But look at it another way, if Datsun is able to muscle its way into the crowded mass segment, Nissan would be well on its way in India.

Renault Extends Standard Warranty On Kwid, Triber, And Kiger To 3...

Hyundai Exter: Welcome To The New World Of Thrills And Technology

Hyundai Creta Level-2 ADAS Explained, Perfect For Indian Road...

Hyundai Exter: An Year Long Ownership Experience That Left Us Wanting...

2024 Toyota Camry Launched In India At Rs 48 Lakh; Now...

Kia Syros Unveiled Globally As The Most Premium Sub-4m SUV In India

Is The Kia Syros More Compelling Than The Best-selling Hyundai Creta?

New 2024 Honda Amaze Arrives In India At Rs 8 Lakh

Auto Expo 2025 - All You Want To Know About The Hottest Auto Show!

Mahindra BE 6 Launched: Price For The Top-spec Variant Is Out!

India's largest automotive community

Kia Syros

Rs. 8.99 Lakh

Kia Syros

Rs. 8.99 Lakh

Vayve Mobility Eva

Rs. 3.25 Lakh

Vayve Mobility Eva

Rs. 3.25 Lakh

BMW X3

Rs. 75.80 Lakh

BMW X3

Rs. 75.80 Lakh

Hyundai Creta Electric

Rs. 17.99 Lakh

Hyundai Creta Electric

Rs. 17.99 Lakh

Lotus Emira

Rs. 3.22 Crore

Lotus Emira

Rs. 3.22 Crore