Auto Expo 2025 - All You Want To Know About The Hottest Auto Show!

- Jan 5, 2025

- Views : 6582

The decade gone by brought much to cheer to the Chinese automobile industry. While the early part of that decade saw the global attention to meet the ever increasing local demand and the blossoming of multiple strong names on the local automotive landscape, the latter half saw the emergence of China as a hub for automotive exports to countries across the world. For example, the exports of motorcycles increased from over 2.5 million in 2001 to over 9 million units last year, and that for passenger cars rose from a mere 10,000 units plus to over 200,000 in this period – symbolising the emergence of China as a hub for automotive exports for countries across the world1.

Three key drivers have led to this phenomenal growth. Firstly, massive economies of scale, distinct labour advantage and much lower spends on R&D have enabled the Chinese to offer price tags which the local players in India and the rest of the world find hard to match. Secondly, agility and flexibility of the Chinese players in their speed to market of new products, features and specs on existing line-up is unmatched, providing them the springboard to capture share, much before local players can react to it. Thirdly, industry friendly policies of the Chinese government have played a key role. Incentives in the form of friendly tax structure, cash benefits for setting up new units and strong export benefits are offered to promote investment in the sector. Being an export-driven economy, the government keeps a strong control over the exchange rate and further, the Free Trade Agreements entered into by China with several export destinations allows auto manufacturers to be more competitive.

The dragon's personality

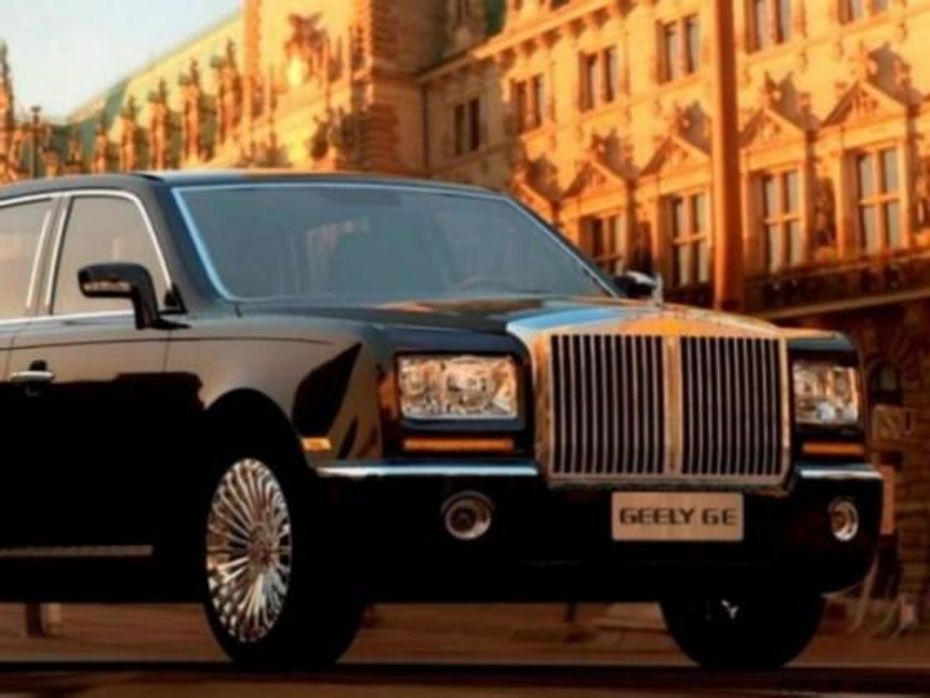

Looking at the success of the Chinese players, two clear traits can be best associated with their game plan – price warriors and market creators. The clear value proposition in most markets that the Chinese players offer is lowest price. They have established new norms of pricing and putting significant pressure on the local incumbents in several markets. In many others they have just driven the competition out. Many markets in which the Chinese are now successful are those where they went in and created a completely new segment which had no prior access to automobiles. For example, several African countries like Kenya, Morocco, Egypt etc have witnessed the rapid increase of motorcycle sales, largely driven by Chinese-led OEMs trying to create a market which did not exist earlier.

But the sustainability of such a strategy is always a question – so far, the Chinese seem to have targeted multiple markets, with a higher focus on less covered markets like Africa, Middle East and South America. But eventually the compromises on quality for lower costs will catch up, and there may not be any new silver bullet market left! The question is what will the dragon do then?

Fighting the dragon

While there is no silver bullet or a formula to beat the Chinese, three avenues offer the greatest promise of a successful retaliation – product innovation, customer education and State support.

Product innovation

In the past, local players have ousted Chinese players from the markets through product innovation. Honda today has more than 50 per cent share in the Vietnamese motorcycle market. This wasn't the case in 2001, when the Chinese had risen to over 80 per cent market share, that too within 2-3 years of entry. Honda, the largest incumbent and the market leader in the 90s, had almost lost its entire share to the Chinese, owing to the significant price differential between the products. Though the quality of Honda products was much superior to the Chinese, the Chinese products were priced half as much as that of the world numero uno, driving the increasing Chinese penetration in the market. Honda reacted sharply by bringing a completely new range in the market which was de-featured significantly in a bid to reduce its cost and in consequence the price. The strategy helped Honda to regain its share and also drive the Chinese out of the market.

Customer education

The other way to retaliate against the Chinese is by educating the customers like Bajaj Auto has done in the Nigerian two-wheeler market. Before Bajaj Auto started making inroads in Nigeria in 2003-04, the Chinese were dominant. Bajaj started initially at the same price as that of the Chinese, but over time was able to educate the customer about the value of higher quality, better fuel efficiency and a longer product life. In effect, Bajaj transitioned the price sensitive customers to a total cost of ownership mindset. It took Bajaj a few years to reach there, but today with over 30 per cent of the market and a 30-40 per cent higher pricing than its Chinese counterparts, it sure has arrived.

State support

One threat the Chinese will face globally is the pressure of the local governments fearing the impact of the Chinese on their local industries. One instance of this was witnessed recently in September 2011, when the Brazilian government, driven by the strong local auto lobby, imposed a 30 per cent additional VAT on all imported cars to beat the threat of the Chinese, which currently constitute more than 15 per cent share of the Brazilian passenger car market. The result? Overnight the Chinese cars ended up being priced much higher reducing their strong competitive advantage over the incumbents and changing the market dynamics quite considerably.

Crystal ball gazing

China is taking a giant leap to stake its claim as one of the largest automobile manufacturing hubs in the world. Is India the next one on their map? Well, only time will tell – but the Indian OEMs can surely learn a lot from their global counterparts in how to beat them at their own game!

Auto Expo 2025 - All You Want To Know About The Hottest Auto Show!

Mahindra BE 6 Launched: Price For The Top-spec Variant Is Out!

Volkswagen Golf GTI Set For India Launch In Mid 2025, Top 5 Things...

JSW MG Motor India Revealed Their New SUV, The MG Majestor At Auto...

Auto Expo 2025: Tata Sierra ICE Concept Breaks Cover, All Details...

VinFast VF3 vs MG Comet EV: A Detailed Comparison Of The Two Cute And...

Here’s A List Of All Cars That Will Be Coming To The Auto Expo...

2025 Tata Nexon Introduced With 3 New Variants And 2 New Colours

The Story Of Tata Sierra: An Icon India Missed And Now Eagerly Awaits

India's largest automotive community

Kia Syros

Rs. 8.99 Lakh

Kia Syros

Rs. 8.99 Lakh

Vayve Mobility Eva

Rs. 3.25 Lakh

Vayve Mobility Eva

Rs. 3.25 Lakh

BMW X3

Rs. 75.80 Lakh

BMW X3

Rs. 75.80 Lakh

Hyundai Creta Electric

Rs. 17.99 Lakh

Hyundai Creta Electric

Rs. 17.99 Lakh

Lotus Emira

Rs. 3.22 Crore

Lotus Emira

Rs. 3.22 Crore